Are your disparate accounting systems hindering your firm’s growth? Many professional services firms rely on a patchwork of spreadsheets and siloed applications to manage their financials, leading to inefficiencies, errors, and missed opportunities. ERP accounting offers a modern solution, integrating all your financial processes into a single, centralized platform. In this blog, we’ll explore the benefits of ERP accounting and guide you through the process of choosing the right system for your firm.

What is ERP Accounting?

ERP stands for Enterprise Resource Planning, and ERP accounting refers to the financial management module within a broader ERP system. It integrates all your core financial processes into a single, centralized platform, eliminating data silos and streamlining workflows.

Here are some of the core functionalities of ERP accounting:

- General ledger management: Track all financial transactions in real-time, ensuring accuracy and compliance.

- Accounts receivable and payable: Automate invoicing, payment processing, and collections to optimize cash flow.

- Payroll, budgeting, and forecasting: Manage payroll, create budgets, and generate forecasts with ease.

- Tax compliance and reporting: Ensure compliance with tax regulations and generate accurate financial reports.

Unlike traditional accounting software, which often focuses on individual tasks, ERP accounting provides a holistic view of your financials, connecting data from across your organization.

Key Benefits of ERP Accounting for Professional Services CFOs

ERP accounting offers a wealth of benefits for CFOs in professional services firms:

- Financial reporting and advanced analytics: Gain insights into project profitability, client performance, and other key metrics.

- Multi-currency and multi-entity support: Manage finances across different currencies and entities if you have global operations.

- Project-specific financial tracking: Track revenue, costs, and profitability for individual projects.

- Integration with existing tools: Ensure the system integrates with your CRM, HR systems, and other essential tools.

- Automation of time and expense management: Streamline time tracking, expense reporting, and billing processes.

How to Select the Best ERP Accounting Software

Choosing the right ERP system is crucial for your firm’s success. Here’s a high-level guide:

- Identify Business Needs: Assess your current challenges, inefficiencies, and required functionalities.

- Consider Scalability: Choose a system that can accommodate your firm’s growth trajectory.

- Evaluate Integration Capabilities: Ensure compatibility with your existing tools and systems.

- Prioritize Industry-Specific Features: Focus on functionalities designed for professional services firms.

- Vendor Reputation and Support: Look for strong customer reviews and robust implementation support.

We have a more detailed guide on our resources page, or you can download it here.

Leading ERP Systems for Professional Services

Here are a few top-rated ERP systems tailored for professional services firms:

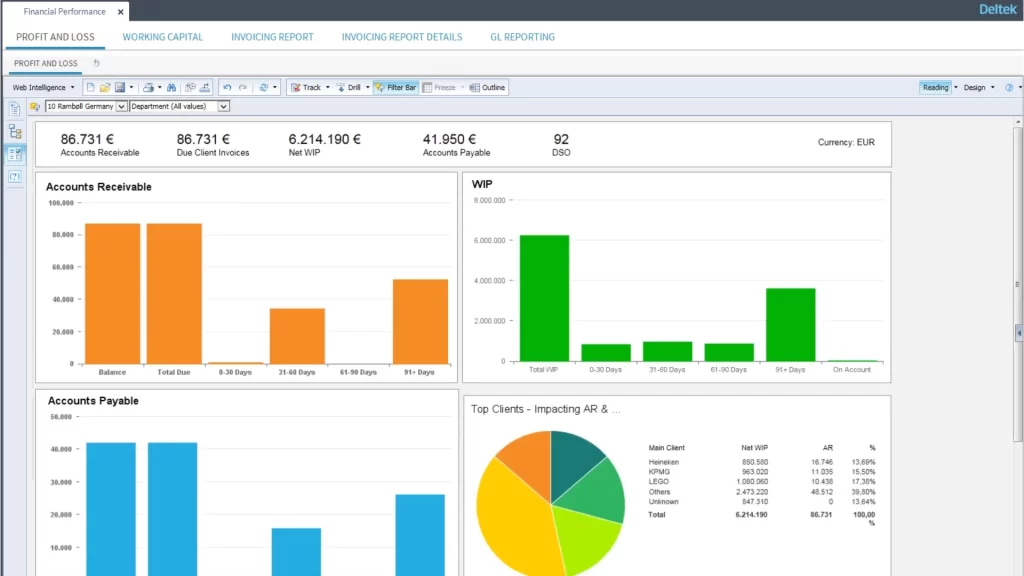

Deltek Maconomy

Deltek Maconomy is purpose-built for project-based businesses, offering comprehensive financial management capabilities. It provides features such as project accounting, budgeting and forecasting, revenue recognition, and real-time reporting. Its strong focus on project-centric financials makes it a good fit for professional services firms that need to track project profitability and manage complex billing arrangements.

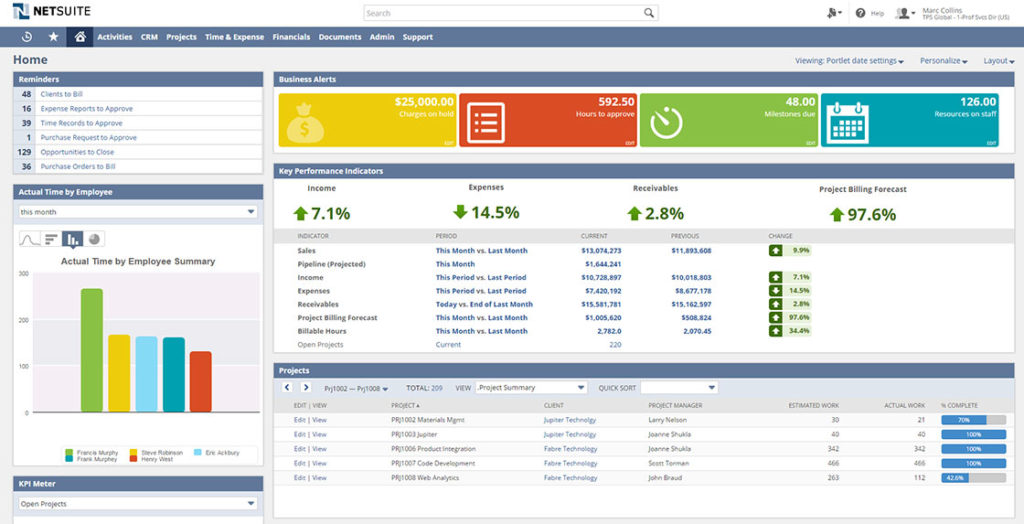

Oracle NetSuite

NetSuite is a leading cloud ERP solution that offers a wide range of functionalities, including accounting, financial planning, and reporting. It provides real-time visibility into financial performance, automates key processes, and supports multi-currency and multi-entity management. NetSuite’s scalability and comprehensive features make it a good choice for growing professional services firms.

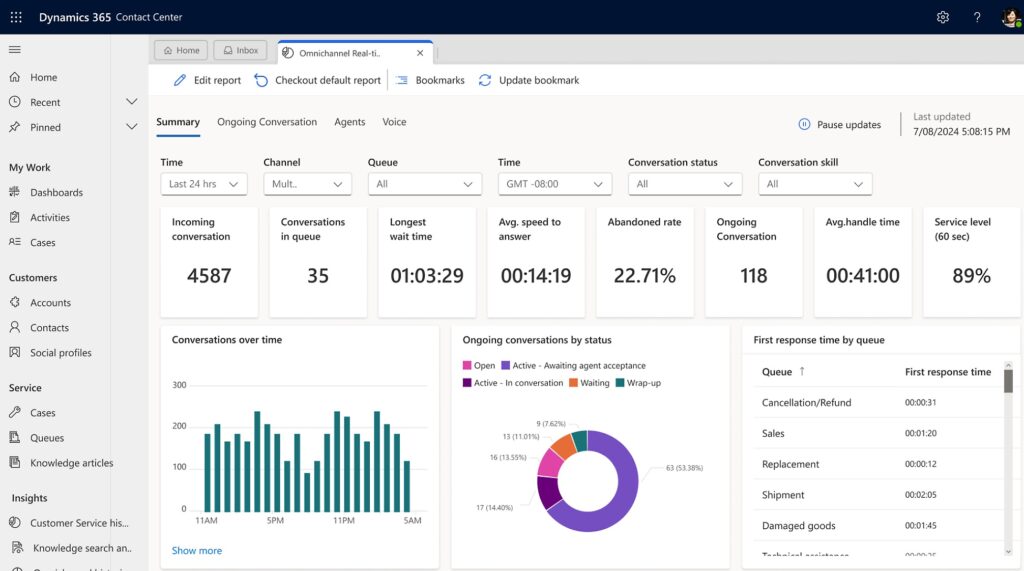

Microsoft Dynamics 365

Dynamics 365 is a robust ERP platform with strong financial management capabilities. It offers features such as general ledger accounting, accounts payable and receivable, budgeting, and project accounting. Dynamics 365 integrates seamlessly with other Microsoft products and provides advanced reporting and analytics capabilities. Its flexibility and integration options make it a good fit for professional services firms looking for a customizable solution.

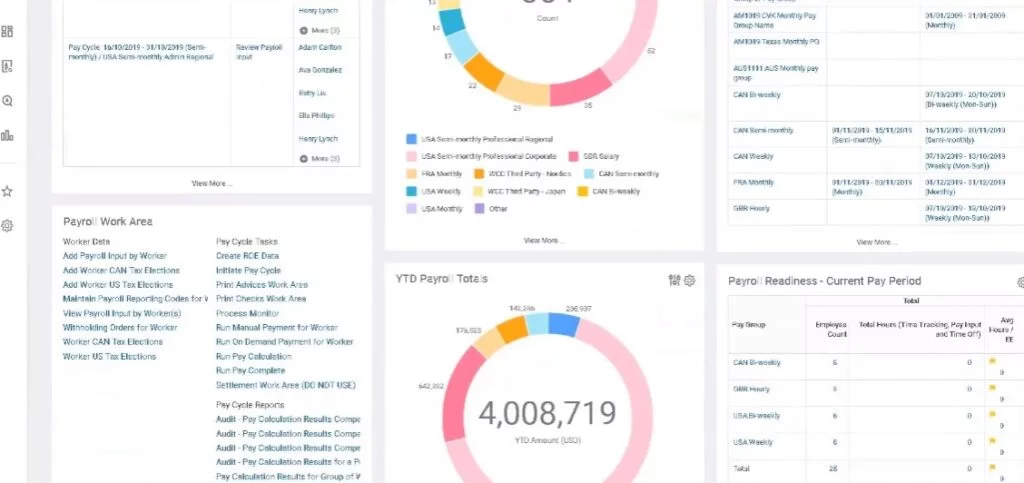

Workday

Workday is a cloud-based ERP system that combines finance and human resources functionalities. It offers features such as financial planning, accounting, procurement, and talent management. Workday’s unified platform provides a holistic view of the organization, enabling better decision-making and collaboration. Its focus on people and finance makes it a good choice for professional services firms that prioritize employee engagement and talent management.

SAP

SAP is a global leader in ERP software, offering a comprehensive suite of solutions for various industries. Its financial management module provides features such as accounting, controlling, treasury, and risk management. SAP’s extensive functionality and global reach make it a good fit for large professional services firms with complex needs. It is not a system we would recommend for an SMB, even if it does have its small business offering “Business One.”

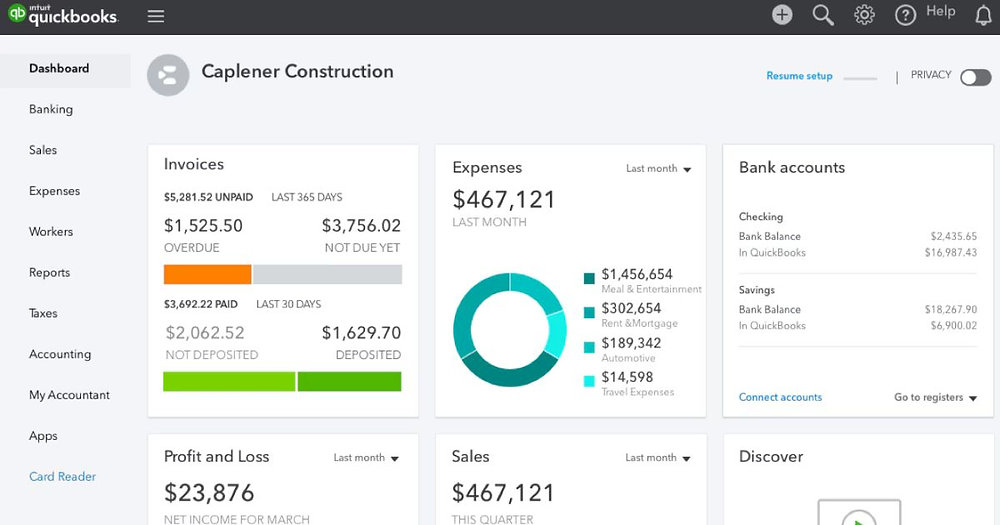

QuickBooks

At the other end of the market, we have QuickBooks. While not a full-fledged ERP system, QuickBooks is a popular accounting software used by many small businesses. It offers basic accounting features such as invoicing, expense tracking, and reporting. Its integration with banks in the US makes it a very attractive proposition. QuickBooks can be a good starting point for small professional services firms, but they may need to migrate to a more comprehensive ERP solution as they grow.

Overcoming Common Challenges in ERP Implementation

Implementing a new ERP system can be complex. Here are some common challenges and how to overcome them:

- Change management: Ensure staff buy-in and provide adequate training to facilitate a smooth transition.

- Data migration: Plan your data migration carefully to avoid delays and ensure data integrity.

- Vendor selection: Choose a vendor with a proven track record in professional services.

- Training and support: Equip your team with the skills and knowledge to maximize the ROI of your ERP system.

Fear not, dear reader. We have guides and resources to help you navigate these challenges. You will find them all on our resources page.

The ROI of ERP Accounting for Professional Services

Investing in ERP accounting can deliver significant returns:

- Improved project profitability: Track project costs accurately and optimize resource allocation.

- Enhanced decision-making: Leverage real-time analytics to make data-driven decisions.

- Cost savings: Automate tasks, reduce manual errors, and streamline processes to save money.

- Better client satisfaction: Ensure accurate and timely billing to improve client relationships.

If you need an ERP cost vs benefit template, you know where to find it! Our resources page.

Conclusion

ERP accounting is no longer a luxury but a necessity for professional services CFOs seeking to stay ahead in today’s competitive landscape. By embracing modern ERP solutions, you can unlock new levels of efficiency, gain valuable insights, and drive sustainable growth.

Ready to transform your financial management?

Fill in the contact form, and we’ll be happy to give you some advice.

Frequently Asked Questions

ERP accounting is the financial management module within an Enterprise Resource Planning (ERP) system. It integrates all your core financial processes into a single platform, providing a holistic view of your financials and streamlining workflows.

Traditional accounting software often focuses on individual tasks, while ERP accounting provides a centralized and integrated approach, connecting data from across your organization.

Key benefits include centralized financial management, real-time insights, improved collaboration, streamlined compliance, and cost and time efficiency.

Consider your business needs, scalability requirements, integration capabilities, industry-specific features, and vendor reputation.

Top options include Deltek Maconomy, Oracle NetSuite, Microsoft Dynamics 365, Workday, SAP, and QuickBooks (for smaller firms).

Challenges include change management, data migration, vendor selection, and training and support.

Download our free resources! Ensure staff buy-in, plan your data migration carefully, choose a reputable vendor, and provide adequate training and support.

Investing in ERP accounting can lead to improved project profitability, enhanced decision-making, cost savings, and better client satisfaction.

- Centralized Financial Management: Eliminate duplicate data entry and gain a single source of truth for all your financial information.

- Real-time Insights: Access up-to-the-minute financial data to make faster, more informed decisions.

- Scalability and Adaptability: Choose a system that can grow with your firm and adapt to evolving needs.

- Improved Collaboration Across Teams: Foster seamless communication between accounting, project management, and HR teams.

- Streamlined Compliance and Risk Management: Automate regulatory compliance and maintain detailed audit trails.

- Cost and Time Efficiency: Reduce manual tasks, improve accuracy, and free up valuable resources.